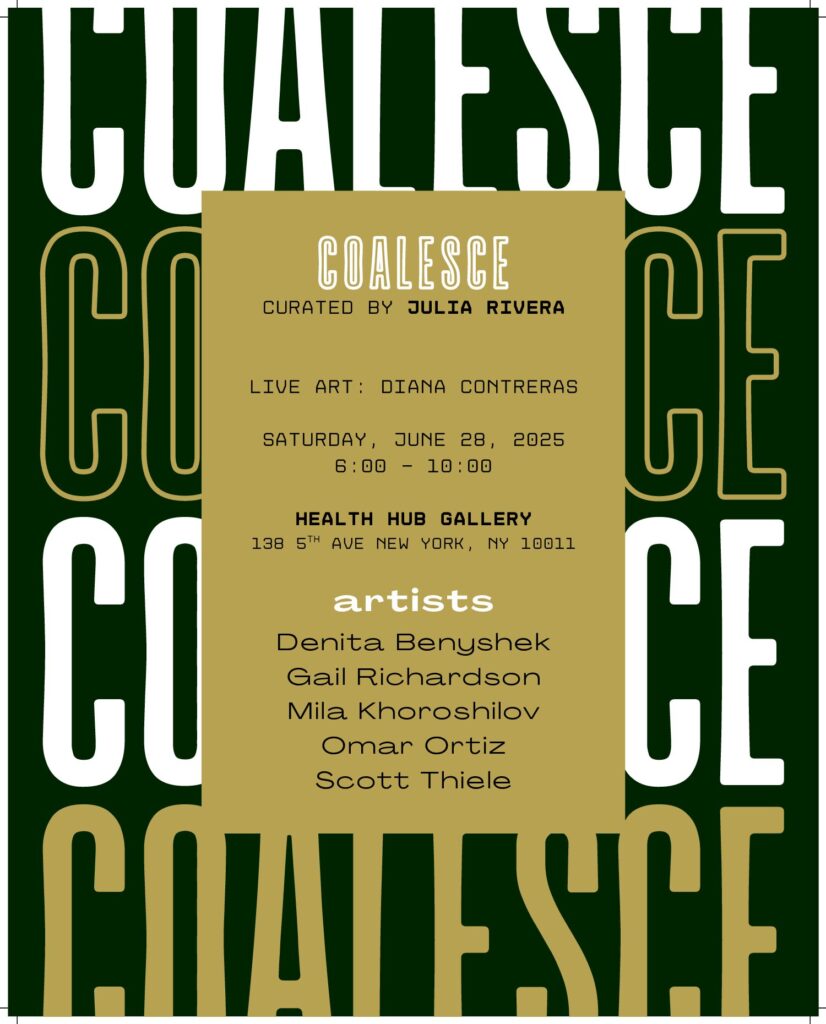

Art events at NYCPT: COALESCE

Join in 6/28/25 for art events at NYCPT. Live art by Diana Contreras.

Why Barre Is the Ultimate Low-Impact Workout for Maximum Results

Barre is the ultimate low-impact workout, balancing intensity and safety while enhancing strength, flexibility, and joint health. It offers a full-body routine suitable for all fitness levels, minimizing injury risk and promoting long-term fitness without overtraining. Ideal for those seeking effective results without high-impact strain, Barre challenges and invigorates participants.

5 Common Barre Mistakes and How to Fix Them for Better Results

5 Common Barre Mistakes and How to Fix Them for Better Results Barre is an incredibly effective workout that targets strength, flexibility, and posture—all while helping you develop lean, toned muscles. But like any workout, it’s easy to make mistakes, especially if you’re new to the class or haven’t yet mastered the technique. Luckily, correcting […]

Barre for Beginners: What to Expect in Your First Class

The blog post “Barre for Beginners: What to Expect in Your First Class” offers newcomers insights into Barre workouts, detailing class structure, essential moves, and preparation tips. It emphasizes Barre’s low-impact, full-body benefits, including improved strength, flexibility, and posture. Newcomers are encouraged to approach classes with an open mind and positive attitude.

AlterG: Defy Gravity, Maximize Recovery, and Enhance Performance

The AlterG Anti-Gravity Treadmill uses NASA-developed technology to reduce impact on joints and muscles, benefiting athletes, post-rehabilitation patients, runners, and individuals with chronic pain. It enables safer training and recovery, enhancing performance and mobility. Experience a transformative approach to fitness and recovery at NY Personal Training with AlterG.

ARE PERSONAL TRAINING SESSIONS TAX DEDUCTIBLE? WHAT YOU NEED TO KNOW

Tax deductions lower taxable income through eligible expenses like medical costs, business expenses, and charitable contributions. For medical deductions, the IRS allows claims for expenses that treat physical or mental issues. Keeping detailed records and consulting a tax professional is crucial for claiming deductions on personal training sessions.